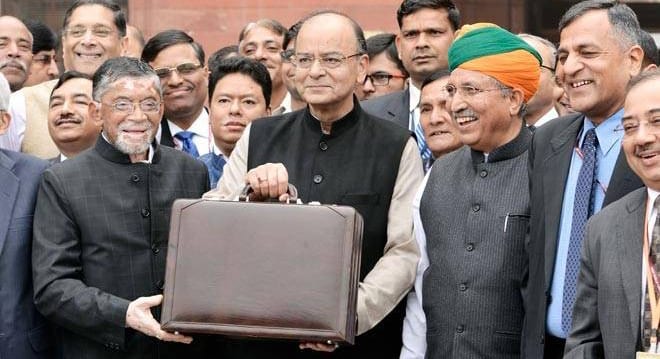

The Union Budget 2017, was presented by Finance Minister Arun Jaitley on Wednesday.

Here are quotes from Industry leaders in the field of technology:

Jay Chen, CEO, Huawei India

“We at Huawei Telecommunications India are pleased to note that the current budget strongly supports the progressive vision of a Digital India set by Hon’ble Government. The allocation of Rs 10,000 crore towards BharatNet will give an overall boost to broadband connectivity in the country. The success of the BHIM app and announcements related to its promotion, Aadhar based swipe machines, and tax exemption to those who use Aadhar based POS machines, will all help accelerate acceptance of digital payments. Furthermore, initiatives like ‘Digital Village’ and ‘Digi-Gaun’ will significantly extend the benefits of digitization to rural India and contribute to a Better Connected India”

Sudhir Kumar, CEO, itel Mobile India

Rajiv Srivastava, MD, HP India

“The Union Budget 2017-18 is extremely positive for the common man, farmers, small and medium businesses and would drive significant growth in Indian economy. Government’s commitment to make taxation rate reasonable, tax administration fair and expand the tax base is the step taken in the right direction. The tax relief given by the Government for the middle-class tax payers will definitely boost the purchasing power, thereby aiding the overall growth of the economy. The major tax relief given to the MSMEs and SMEs with an annual turnover of Rs. 50 crores, would enable them to invest in job creation, increase capital expenditure and explore their digital journey.

The strong emphasis laid on technology in almost all the development areas in the budget reaffirms that technology has been at the forefront of India’s recent economic growth and digital transformation. It has been recognized as an important enabler across initiatives ranging from agriculture to skill development to manufacturing and infrastructural development. The Government’s focus on making India a digital payment economy will definitely help companies like HP to contribute in technology adoption in rural and semi-urban areas, thereby bringing the Digital India’ vision closer to reality. We also welcome the Finance Minister’s commitment to introduce and implement Goods and Services Tax (GST) as per schedule and start GST awareness programme from April 1, 2017 for all stakeholders.”

Kuldeep Malik, Country Head – Corporate Sales International, MediaTek India

“We were expecting Financial Budget 2017 to offer incentives to start inflow towards design led manufacturing in place of assembly led manufacturing ecosystem, but it seems government not yet convinced towards adopting multiple layered incentives for localization while increasing the duties on CBU (Completely built Units), overall based on the information available from the budget the impact of the policies seems to be neutral for mobile/tablet industry, at best.

There has been a 2% increase in duties levied on import of PCBA in India, which still will reflect only on one part of the manufacturing cycle with focus on assembly of mobile handsets. On the other hand, providing attractive incentives for localization of design and R&D capabilities would have bolstered the ‘Make in India’ initiative, and driven more handset makers to introduce design led manufacturing in India.

Post demonetization government seems to be totally convinced towards digital payment adoption, and there is one key development towards ‘Digital India’ program, where Government has decided to waive all duties (SAD/CVD, BCD) levied on mPOS systems, which in turn means that the POS devices will become cheaper and hence we can expect the adoption of such devices, even in grass root level, to grow exponentially in the coming year, helping drive forward the mobile payments ecosystem.” Considering the adoption of Aadhar based payment government has also waived of duties from components such as IRIS scanner, fingerprint readers.”

Andy Stevenson, Head of India, Turkey and Middle East, Fujitsu

“Fujitsu is enthused by the slew of measures being introduced in Budget 2017. While the move towards an internal ‘borderless’ nation will obviously benefit the nation, as has been discussed in various forums – an emphasis on infrastructure in terms of electrification, digital services, roads etc. will further build on the foundation to India being a world class economy.”

Narendra Bansal, Chairman and Managing Director, Intex Technologies

“I see this budget as reformist that gives a clear roadmap for the future course of economic growth in the country. The renewed emphasis on digital payments or transactions will strengthen the cashless economy and enhance the sale of mobile phones and make them the centrepiece of the digital revolution, spurring their demand at the grassroots level. The Budget also makes an honest attempt in checking the funding of political parties and focusses on fundamental reforms by giving outlays for farmer incomes, rural upliftment and relaxing income tax. These steps will further give an impetus to consumer demand and act as a catalyst in accelerating and expanding the economy.”

Akshay Dhoot, Head, Technology and Innovation, Videocon

“We congratulate the Central Government for presenting a growth conducive budget. The overall announcements seems like a cohesive push for holistic economic growth. We welcome initiatives that will give further boost to Make in India in order to make our country a hub of electronic and tech manufacturing. This has been taken care of with announcements like incentivising local electronic manufacturing up to Rs.745 crore by enhancing special policies like Modified Special Incentive Package Scheme (MSIPS) and Electronic Development Fund (EDF). This move would definitely give more sops to domestic mobile handset makers. India is one of the fastest growing mobile markets in the world and it would further get boost from newly formed trade infra export scheme.”

Vinu Cheriyan, CFO & Director Operations at Sennheiser Electronics India Pvt Ltd

The Union Budget 2017-18 significantly focuses on bringing socio-economic development and digitalization in the country while emphasizing on the nine key initiatives for economic reforms — Farmers and rural population, youth education and job opportunities, poor and underprivileged, infrastructure, financial sector, digital economy, public service, prudent fiscal management and tax administration. With increase in Foreign Direct Investment and Foreign Exchange reserve, India has now emerged as one of the fastest growing economy with an accelerated growth in 2016-2017.It is also quite encouraging to see that investment on infrastructure has been given priority at today’s budget while focusing on the GDP growth.

Budget mainly focused on digitalization of the economy as an integral part like; introducing Aadhaar Pay an enabled payment system to be launched shortly for those without debit cards and mobile phones and initiating high broadband connectivity in more than 1 Lakh villages which will help rural India move one step closer to a digital economy. Rs.10,000 Crore have also been allotted for the recapitalisation of public banks which will in turn regain the spending capacity of the masses and hence, accelerate economic growth. Another great initiative by our finance ministry is the establishment of over 100 skill centres in 2017 to provide training in foreign languages and various other skills to the youth of our country to maximise their potential. We personally think it is a great initiative as it will help our economy reach the desired GDP. It is also great to see that both corporates and salaried employees are relieved in the budget as there is relief in personal income taxes and other various taxes. The budget also mentioned our Finance Minister’s initiative to create an ecosystem and make India a hub for electronic manufacturing by increasing the allocation of schemes related to these to Rs 745 crores. This budget has been a great initiative keeping in mind the various obstacles in the growth of our economy. We wish our Finance Minister a great luck for the successful implementation of Budget 2017.

Deb Deep Sengupta, President and Managing Director, SAP Indian Subcontinent

“The recommendations in the Union Budget 2017 are tailored to accelerate growth for midsize companies. Our commitment, through SAP S/4HANA Private Cloud, is to provide each and every Indian business the opportunity to tap into the power and potential of SAP HANA as they pave the way towards a pervasive digital business.”

Bipin Preet Singh, Founder & CEO, MobiKwik

Big digital push is the thrust of the Budget and is a very welcome and the right move for the future growth of the economy. I commend this progressive budget that invests heavily in technology and digitization. The focus on digital payments will lead to revolutionary transformation in Indians’ payment habits. Digital payments will be the new normal in 2017 and we are very excited about this. As we become more digital, India will see new taxpayers and better transparency in incomes.

Upgrading digital infrastructure to support cashless transactions in rural and semi urban areas will encourage more merchants and consumers to transact on non-cash and online platforms. However, we feel that the government must have also considered promoting startups in the digital payments and digital security areas. Secure digital transactions is the only way to sustain India’s habit of cashless payments.

The budget also promoted the startup ecosystem with tax benefits. Reduction in the corporate tax for Medium and Small Scale Enterprises (MSMEs) to 25% will also go a long way in attracting more investment in the country. It will surely give the domestic sector a massive push and indirectly help the country in restoring its healthy GDP growth forecast.

Overall the Budget proposals look to boost consumption. The impetus on affordable housing and rural infrastructure will boost lower and middle income and translate into consumption.

Rahul Gochhwal, C0-Founder, TRUPAY, Digital Payment App

“Though it remains to be seen if the proposed setting up of Payments Regulation Board under RBI and amendments in the Payments and Settlement Act will bring about fundamental changes to accommodate the fast changing digital payments ecosystem in the country. The budget will help Transforming India into a less cash economy to tackle the issue of corruption and clean up the system is one of the integral strategies of the government.

Digital payment infrastructure would be strengthened, along with the grievance handling system. Up gradation of digital infrastructure will encourage non-cash payments.”

Vijay Shekhar Sharma, Founder & CEO, Paytm

Abhesh Verma, COO, nexGTV

Manavjeet Singh, Founder & CEO, Rubique

Also, we had covered the #Budget2016 extensively for our readers from every perspective. If you missed our coverage of Budget 2016 reactions by Smartphone and Mobile Handset Makers then you can read it here.