Xiaomi, in India, has already dominated with their smartphones, smart TVs, and other smart living products. Today, the company has announced ‘Mi Credit, a digital lending solution platform for India. Mi Credit is Xiaomi’s second Mi Finance solution to be launched in India after Mi Pay, which is a UPI based payment app with more than 20 million active users.

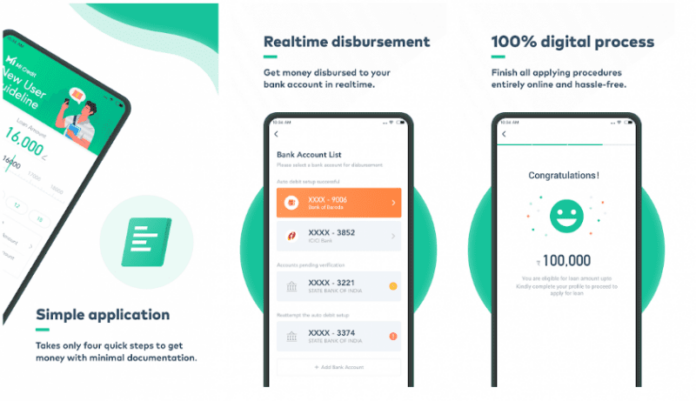

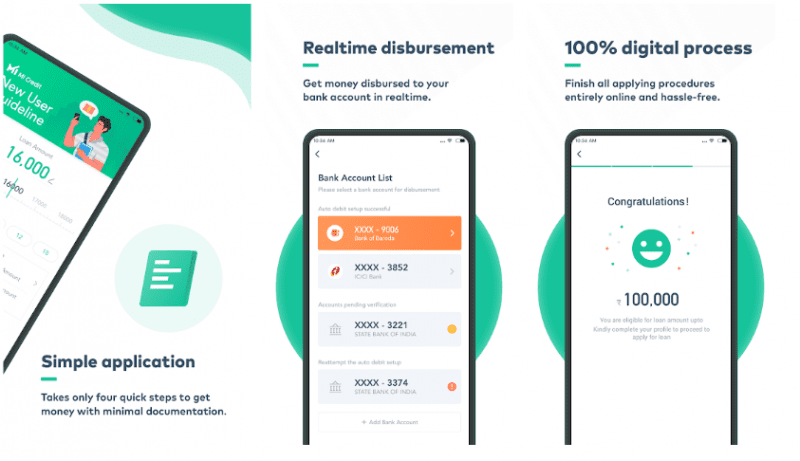

Mi Credit is an online curated marketplace for lending, to offer the best personal loans to users. The current lending partners are primarily NBFCs or Fintechs such as Aditya Birla Finance Limited, Money View, EarlySalary, Zestmoney, and CreditVidya. It is built as the first personal loan choice for aspirational young professionals and millennials. Mi Credit tries to solve most challenges associated with the traditional lending industry with a 100% digital experience.

Mi Credit provides an easy application process for securing loans, with an intuitive interface. First-time users can complete the digital application form within five minutes, and repeat customers can avail a loan with one click disbursement. Once the loan is approved within minutes, the consumer has the option to choose the amount and the tenure of the loan. The digital advantage also shows in realtime disbursement of loans and lower interest rates.

Users can also check their credit score instantly on the app, for free, powered by Experian. All user data on Mi Credit is stored securely in encrypted format in India through our partner Amazon Web Services Cloud Infrastructure. Mi Credit has been running in India in a pilot format and has already disbursed loans of over 28 crores (approximately ~1 Cr / day) in November 2019. Over 20% of the users have availed the highest amount of loan INR 1 lakh. Currently, Mi Credit services more than 10 states spanning across 1,500 pin codes, and aims to expand its availability to 100% of the pin codes (more than 19,000 pin-codes) by the end of FY2019.

Note: Rate of Interest starts at 1.35% per month

The Mi Credit app comes preloaded on all MIUI phones, and can also be downloaded from Google Play Store and GetApps, Xiaomi’s own app store.

Manu Jain, Vice President, Xiaomi and Managing Director, Xiaomi India further added, “In India, the lending industry is on an explosive trajectory. As per a recent report from CIBIL, there are over INR 4 lakh crores worth of personal loans outstanding from nearly 1.9 crore customers, with each user accounting to an almost INR 2 lakh of outstanding amount. Of these 1.9 crore customers, majority tend to avail it for medical emergencies followed by shopping, wedding, travel and education purposes. We are bringing Mi Credit to India hoping to provide yet another innovative and truly digital solution for their lending needs.”

Follow us on Twitter for more news and updates.