What come to your mind when you hear the word jiffy? Instant noodles or maybe “I am in a meeting. Call you back in a jiffy”. There may be more scenarios where you would use the word jiffy but never when it comes to banking. Just the thought of banking has been dreadful for many, forget about actually visiting a bank and getting work done. I really can’t recall when was the last time I actually visited a bank branch for work, its either online or it never happens.

I remember the first few bank accounts I opened were eventually shut down for not being able to maintain them due to lack of visits to the branch. I could finally open and keep an account active when Internet Banking came along.

That said, you all would agree that even though internet banking has come a long way its still not up to the mark. There are still a lot of tasks that are not possible with Internet banking, and even if they are possible the procedure to complete them is very slow. For example, if you need a new cheque book, you would need to login to your internet banking and then raise a service request, and then after 24-48 hours that request is looked at by the banking officials. But come to think of it, what else can be done to complete these requests more efficiently? Have we reached the optimum of the way banking works online?

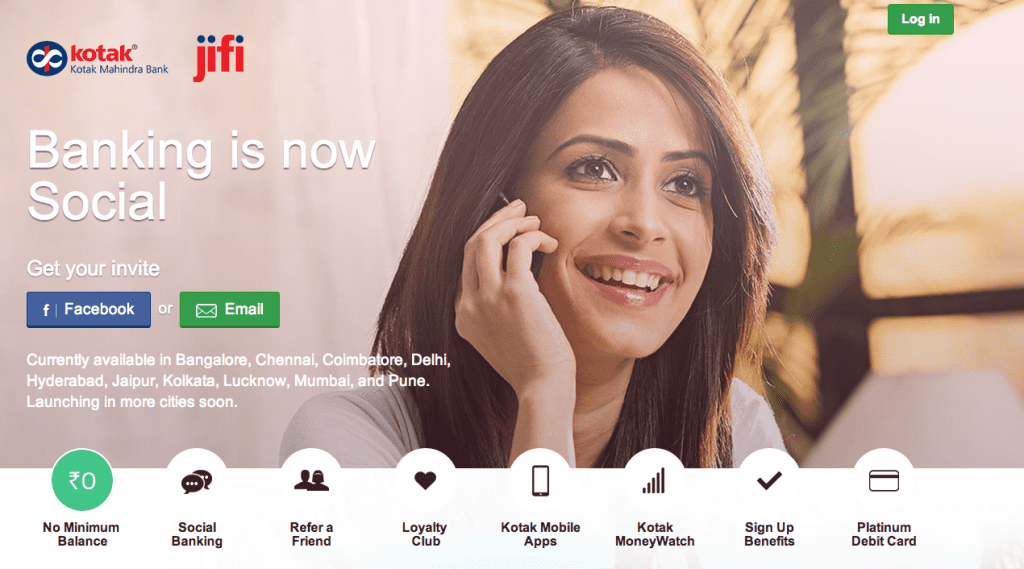

Well until last week, I would have said yes but Kotak Mahindra Bank has come up with something so innovative and user-friendly that Internet Banking looks passé. Nobody else thought of it but social banking is the new age banking and Kotak Mahindra Bank has taken the lead with Jifi!

What Jifi offers:

1) Zero Balance Account

Enjoy all the benefits of a regular account, without worrying about tracking and maintaining monthly balances.

Jifi is a non-interest bearing account, however it does not have any minimum balance requirements. What’s more, it pays high interest on balances over Rs.25,000 by automatically creating term deposits with your spare cash.

2) The Loyalty Club

Share or transact. Get rewarded for both.

3) Platinum Debit Card

It’s Platinum, it’s yours! Jifi Debit Card comes with a host of premium benefits catered to your taste. A chip based debit card, that offers added security at PoS terminals and gives you a higher withdrawal limit at ATMs.

4) Social Banking

Seriously who thought of getting banking tasks done by using just hashtags? Twitter banking means your account balance, transaction history, cheque book request and many more activities are now just a tweet away.

If you are still not convinced then we bet you would give in Jifi after watching the videos we saw at the Indiblogger #JifiIsHere meet 🙂

All the above videos are brilliant in terms of brand connect, creativity and getting the message across. None of the advert feels like a forced commercial we see from other brands. It’s more of a series of friends sharing their story about Jifi 🙂

We would like to tell Kotak Mahindra Bank and Indiblogger that after successful launch of Jifi. Let’s update the hashtag from #JifiIsHere to #InLoveWithJifi cos we really are 🙂