Just when Indians are trying to imbibe technology in every sphere of their lives – from travel, food to entertainment; financial investments are still a laggard in comparison. India has an ever growing base of smartphone users who are keen to digitize every aspect of their lives including money. These digital natives are seeking means to make smart investments or better plan their financial life — all right from their smartphones.

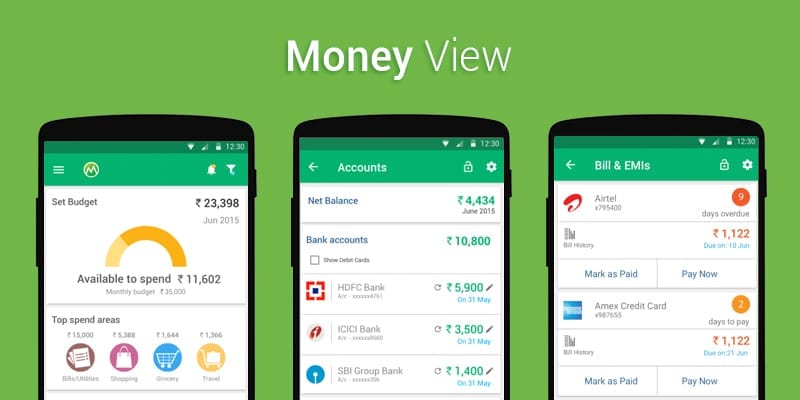

‘Green Account’, an innovative and first-of-its kind app-based solution from Money View, India’s leading money management app and ICICI Prudential Mutual Fund, a leading Mutual Fund (MF), is an effort in the direction to digitize the yet untapped investment scene; thereby enabling Indians to become financially fit; Save & Grow money smartly while on-the-go. Green Account platform will offer two exclusive products Savings+ and Tax Saver+ from ICICI Prudential.

Savings+ is designed to get users in the habit of saving money regularly for their short and medium term goals – like buying a car, taking a family vacation, creating an emergency fund, etc. The product serves as a suitable alternative to traditional saving options. These savings could grow by allowing users to park them in Liquid Funds offered by ICICI Prudential Mutual Fund. Furthermore, such schemes usually have no exit load or withdrawal penalty, which gives users the flexibility to withdraw the funds whenever they need.

Tax Saver+, the second product offered through this partnership, helps users save on their tax by investing in Equity Linked Savings Scheme (ELSS) option provided by ICICI Prudential Mutual Fund. Users can save up to Rs. 46,350 in taxes depending on their tax rate by investing up to Rs. 1.5 lac annually.

ICICI Prudential Mutual Fund and Money View have integrated their systems to make this offering completely digital. Users can create a new account by completing a quick and easy paperless application form within the Money View app and start investing through Savings+ and Tax Saver+. The app not only enables users to invest but also helps them manage their portfolio – invest more or withdraw funds (subject to applicability of lock-in period for ELSS) anywhere anytime with just a few taps on the Money View app.

The launch of the ‘Green Account’ platform, offering these two products, transitions the app from being a budget management app to a personal money manager by providing smart options to save and invest their money on-the-go.